As a bank, the most impactful way to address the topic of sustainability is through our financing activities. To deliver meaningful impact, and to support our customers’ ESG values and ambitions to transition, we have integrated sustainable products and services as part of our corporate banking value proposition.

QNB continues to drive sustainable financing and client engagement to further develop and grow its portfolio to support the climate transition.

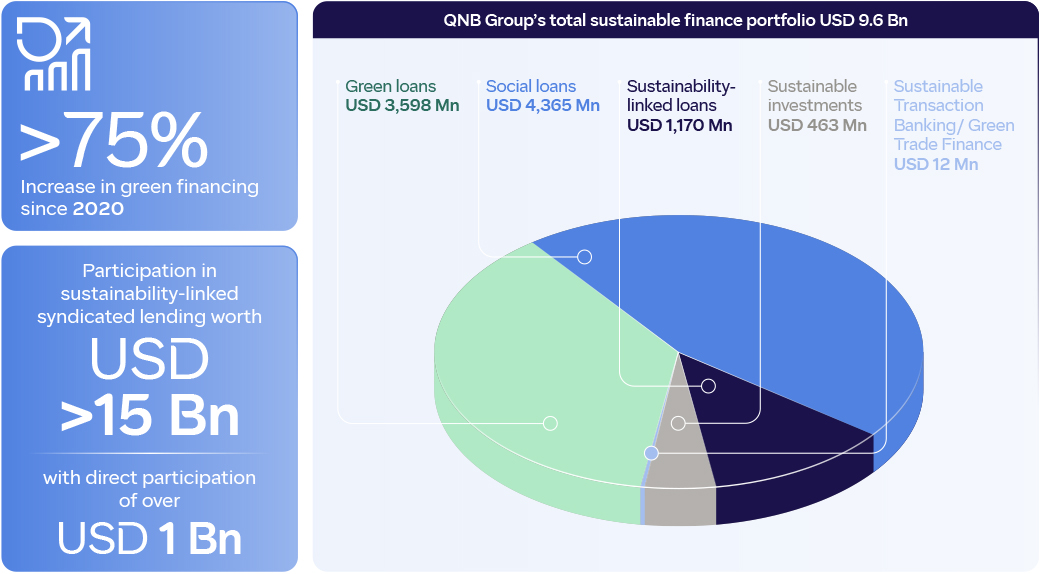

QNB Group’s total sustainable finance portfolio (as at 31-Dec-24)

Risk and Opportunity Management in Sustainable Finance

As part of our effort to mitigate our environmental and social risk, we apply the Environmental and Social Risk Management (ESRM) Policy Framework, which integrates exclusions, prohibited activities, and E&S criteria as part of the overall lending and credit approval decision process.

In order to benefit from the sustainable finance opportunities, we leverage our Sustainable Finance and Product Framework (SFPF), which elaborates on our classification approach and methodology for labelling any products, services or transactions as Sustainable or Transition finance, aimed at delivering positive impact to society and the environment.

Sustainable Finance Documents and Reports

2025

2023

- Sustainable Finance and Product Framework

- Sustainable Finance and Product Framework – Second Party Opinion

2021

- Green, Social and Sustainability Bond Framework

- Green, Social and Sustainability Bond Framework - Second Party Opinion

- Post Issuance Green Bond Impact Report

- Post Issuance Green Bond Allocation Report

- Deloitte Green Bond Assurance Report